Tax Deducted at Source (TDS) is a system introduced by Income Tax Department, where person responsible for making specified payments such...

Tax Deducted at Source (TDS) is a system introduced by Income Tax Department, where person responsible for making specified payments such as salary, commission, professional fees, interest, rent, etc. is liable to deduct a certain percentage of tax before making payment in full to the receiver of the payment. As the name suggests, the concept of TDS is to deduct tax at its source.

A significant part of Income tax collection comes through TDS ,so Tax machinery is monitoring the TDS collection minutely.

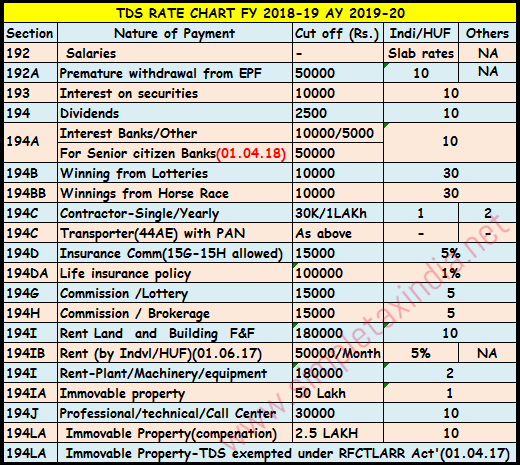

In view of above ,Deduction of Tax at correct rate is very important for deductor and minor mistake in deduction leads to penalty in shape of Interest on late deposit and disallowance of Expenses. We have Compiled Tax deduction rates chart (TDS rate chart) for Financial year 2018-19 Assessment year 2019-20 which may be useful for all the readers.

Kindly give suggestion/queries/errors/amendments in comment section or raniraj1950 at gmail.com , suitable prizes will be given to persons who will point out error(s) or sent good suggestions about this post.Copy paste has been disabled .

Kindly give suggestion/queries/errors/amendments in comment section or raniraj1950 at gmail.com , suitable prizes will be given to persons who will point out error(s) or sent good suggestions about this post.Copy paste has been disabled .

1.

TDS RATE CHART FY 2018-19

AY 2019-20

TDS RATE CHART FY 2018-19 AY 2019-20

|

||||

Section

|

Nature of Payment

|

Cut off (Rs.)

|

Indi/HUF

|

Others

|

192

|

Salaries

|

-

|

Avg rates

|

NA

|

192A

|

Premature withdrawal from EPF

|

50000

|

10

|

NA

|

193

|

Interest on securities

|

10000

|

10

|

|

194

|

Dividends

|

2500

|

10

|

|

194A

|

Interest Banks/Other

|

10000/5000

|

10

|

|

For Senior citizen(01.04.18)

|

50000

|

|||

194B

|

Winning from Lotteries

|

10000

|

30

|

|

194BB

|

Winnings from Horse Race

|

10000

|

30

|

|

194C

|

Contractor-Single/Yearly

|

30K/1LAKh

|

1

|

2

|

194C

|

Transporter(44AE) Declaration with PAN

|

As above

|

-

|

-

|

194D

|

Insurance Comm(15G-15H allowed)

|

15000

|

5%

|

|

194DA

|

Life insurance policy

|

100000

|

1%

|

|

194EE

|

NSS

|

2500

|

10

|

NA

|

194G

|

Commission /Lottery

|

15000

|

5

|

|

194H

|

Commission / Brokerage

|

15000

|

5

|

|

194I

|

Rent Land and Building

F&F

|

180000

|

10

|

|

194IB

|

Rent (by Indvl/HUF)(01.06.17)

|

50000/Month

|

5%

|

NA

|

194I

|

Rent-Plant/Machinery/equipment

|

180000

|

2

|

|

194IA

|

Immovable property

|

50 Lakh

|

1

|

|

194J

|

Professional/technical Fees

|

30000

|

10

|

|

194J

|

Payment to Call Center(01.06.17)

|

30000

|

2

|

|

194LA

|

Immovable Property(compenation)

|

2.5 LAKH

|

10

|

|

194LA

|

Immovable Property-TDS exempted

under RFCTLARR Act'(01.04.17)

|

|||

TDS RATE

CHART FY 2018-19 AY 2019-20

|

||||

Sec

|

Nature of

Payment

|

Cut off (Rs.)

|

Indi/HUF

|

Others

|

192

|

Salaries

|

-

|

Avg rates

|

NA

|

192A

|

Premature withdrawal from EPF

|

50000

|

10

|

NA

|

193

|

Interest on securities

|

10000

|

10

|

|

194

|

Dividends

|

2500

|

10

|

|

194A

|

Interest Banks/Other

|

10000/5000

|

10

|

|

For Senior citizen(01.04.18)

|

50000

|

|||

194B

|

Winning from Lotteries

|

10000

|

30

|

|

194BB

|

Winnings from Horse Race

|

10000

|

30

|

|

194C

|

Contractor-Single/Yearly

|

30K/1LAKh

|

1

|

2

|

Transporter(44AE) Declaration with PAN

|

As above

|

-

|

-

|

|

194D

|

Insurance Comm (15G-15H allowed)

|

15000

|

5%

|

|

194DA

|

Life insurance policy

|

100000

|

1%

|

|

194EE

|

NSS

|

2500

|

10

|

NA

|

194G

|

Commission /Lottery

|

15000

|

5

|

|

194H

|

Commission / Brokerage

|

15000

|

5

|

|

194I

|

Rent Land

and Building F&F

|

180000

|

10

|

|

194IB

|

Rent (by Indvl/HUF)(01.06.17)

|

50000/Month

|

5%

|

NA

|

194I

|

Rent-Plant/Machinery/equipment

|

180000

|

2

|

|

194IA

|

Immovable property

|

50 Lakh

|

1

|

|

194J

|

Professional/technical Fees

|

30000

|

10

|

|

194J

|

Payment to Call Center(01.06.17)

|

30000

|

2

|

|

194LA

|

Immovable Property(compenation)

|

2.5 LAKH

|

10

|

|

194LA

|

Immovable Property-TDS exempted under

RFCTLARR Act'(01.04.17)

|

|||

TDS RATE

CHART FY 2018-19 AY 2019-20

|

|||

Nature of Payment Made To

|

Indivi/ HUF

|

Other

|

|

Section - Description

|

Cut off (Rs.)

|

Rate (%)

|

|

192 - Salaries

|

-

|

Avg rates

|

NA

|

192A-Premature withdrawal from EPF

|

50000

|

10

|

NA

|

193 - Interest on securities

|

10000

|

10

|

|

194 - Dividends

|

2500

|

10

|

|

194A - Interest Banks

|

10000

|

10

|

|

194A - Interest other

|

5000

|

10

|

|

194A-Interest Senior citizen(01.04.18)

|

50000

|

10

|

|

194B - Winning from Lotteries

|

10000

|

30

|

|

194BB - Winnings from Horse Race

|

10000

|

30

|

|

194C- Contractor - Single Transaction

|

30000

|

1

|

2

|

194C- Contractor-During the F.Y.

|

1 LAKH

|

1

|

2

|

194C- Transporter (44AE) declaration with

PAN

|

-

|

-

|

-

|

194D - Insurance Commission(15G-15H allowed)

|

15000

|

5

|

|

194DA

Life insurance Policy

|

100000

|

1

|

NA

|

194E

-Non-Resident Sportsmen or Sports Association

|

-

|

20

|

|

194EE

- NSS

|

2500

|

10

|

NA

|

194F - Repurchase Units by MFs

|

-

|

20

|

|

194G - Commission - Lottery

|

15000

|

5

|

|

194H - Commission / Brokerage

|

15000

|

5

|

|

194I -

Rent Land and Building

- F&F

|

180000

|

10

|

|

194I

Rent Plant/Machinery/equipment

|

2

|

||

194I- Rent by Individual/HUF(01.06.2017)

|

50000/PM

|

5

|

NA

|

194IA -Transfer of certain immovable

property other than agriculture land

|

50 Lakh

|

1

|

|

194J - Professional Fees

|

30000

|

10

|

|

194LA - Immovable Property(compensation)

|

2.5 Lakh

|

10

|

|

194LA - Immovable Property(TDS exempted

under RFCTLARR Act'(01.04.2017)

|

|||

TDS RATE CHART FY 2018-19 AY

2019-20

|

|||

Nature of Payment Made To

|

Indivi/ HUF

|

Other

|

|

Section – Description

|

Cut off (Rs.)

|

Rate (%)

|

|

194LB - Income by way of interest from infrastructure debt fund

(non- resident)

|

-

|

5

|

|

194LB - Income by way of interest from infrastructure debt fund

(non- resident)

|

-

|

5

|

|

Sec 194 LC

- Income by

way of interest by an Indian

specified company to a non-resident / foreign company on foreign currency

approved loan / long-term infrastructure bonds from outside India (applicable

from July 1, 2012)

|

-

|

5

|

|

194LD - Interest on certain bonds and govt. Securities(from

01-06-2013)

|

-

|

5

|

|

196B - Income from units

|

-

|

10

|

|

196C-Income from foreign currency bonds or GDR (including

long-term capital gains on transfer of such bonds) (not being dividend)

|

-

|

10

|

|

196D - Income of FIIs from securities

|

-

|

20

|

|

Section 192

|

|

Nature of Payment

|

Salary

|

Deductor

|

Any person (employer)

|

Deductee

|

Any person (employee) individual

|

TDS rate

|

As per Slab rate applicable to

individual

|

Threshold Limit

|

If Tax payable is nil on Salary

Income

|

Time of deduction

|

At the time of Payment

|

Other points

|

Negative Income of House property

may be Considered for TDS calculation

|

192A

|

|

Nature of Payment

|

Premature withdrawal from EPF

|

Deductor

|

EPFO

|

Deductee

|

Resident

|

TDS rate

|

10%

|

Threshold Limit

|

50000 wef 01.06.2016

|

Time of deduction

|

At the time of Payment

|

Other points

|

TDS is applicable only if withdrawn

before 5 year of contribution

|

Section 193

|

|

Nature of Payment

|

Interest on securities

|

Deductor

|

any person

|

Deductee

|

Resident

|

TDS rate

|

10%

|

Threshold Limit

|

Govt securities -10000

Debenture-5000

|

Time of deduction

|

credit or payment whichever is

earlier

|

Other points

|

|

Section 194

|

|

Nature of Payment

|

Deemed dividend

|

Deductor

|

Indian company /company making

payment in India

|

Deductee

|

Resident

|

TDS rate

|

10%

|

Threshold Limit

|

2500 to Individuals paid a/c payee

cheque

|

Time of deduction

|

Distribution or payment whichever

is earlier

|

Other points

|

No tds on exempted dividend u/s

10(34)

|

Section 194A

|

|

Nature of Payment

|

Interest other than securities

|

Deductor

|

(1)Any person other than Individual

/HUF (2) Individual Huf having sales turnover /receipts exceeding the limit

provided under section 44AB in immediately preceding year

|

Deductee

|

Resident

|

TDS rate

|

10%

|

Threshold Limit

|

10000(50000 for senior citizen)

from banks 5000 from others

|

Time of deduction

|

credit or payment whichever is

earlier

|

Other points

|

Adjustment in deduction

increase/decrease can be made same as under section 192(salary)

|

Section 194B

|

|

Nature of Payment

|

winning from lottery/crossword

puzzle etc

|

Deductor

|

any person

|

Deductee

|

any person

|

TDS rate

|

30%

|

Threshold Limit

|

10000

|

Time of deduction

|

At the time of Payment

|

Other points

|

Tax is deductible even for prize in

Kind

|

Section 194BB

|

|

Nature of Payment

|

Winning of Horse race

|

Deductor

|

any person

|

Deductee

|

any person

|

TDS rate

|

30%

|

Threshold Limit

|

10000 form 01.06.2016

|

Time of deduction

|

At the time of Payment

|

Other points

|

|

Section 194C

|

|

Nature of Payment

|

TDS from payment to contractor sub

contractor

|

Deductor

|

As per details

|

Deductee

|

Resident

|

TDS rate

|

if payee is individual/huf:1% other

:2%

|

Threshold Limit

|

Single :30000 Total FY 100000 wef

01.06.2016

|

Time of deduction

|

credit or payment whichever is

earlier

|

Other points

|

Material value excluded if shown in

bill separately

|

194D

|

|

Nature of Payment

|

Insurance Commission

|

Deductor

|

Insurance company

|

Deductee

|

Resident

|

TDS rate

|

5% wef 01.06.2016

|

Threshold Limit

|

15000 from 01.06.2016

|

Time of deduction

|

credit or payment which ever is

earlier

|

Other points

|

Form 15G-15H allowed wef 01.06.2017

|

Section 194DA

|

|

Nature of Payment

|

Payment of Life insurance not

exempted u/s 10(10D)

|

Deductor

|

any person

|

Deductee

|

Resident

|

TDS rate

|

1% wef 01.06.2016

|

Threshold Limit

|

100000

|

Time of deduction

|

At the time of Payment

|

Other points

|

No deduction on payment on death of

deductee

|

Section 194EE

|

|

Nature of Payment

|

payment of National saving

scheme(deduction claimed 80CCA)

|

Deductor

|

any person

|

Deductee

|

Individual or HUF

|

TDS rate

|

10% wef 01.06.2016

|

Threshold Limit

|

Rs 2500

|

Time of deduction

|

At the time of Payment

|

Other points

|

No deduction on payment to heirs

|

194F

|

|

Nature of Payment

|

Units of Mutual Funds/UTI(deduction

claimed 80CCB)

|

Deductor

|

any person

|

Deductee

|

Individual or HUF

|

TDS rate

|

20%

|

Threshold Limit

|

2500

|

Time of deduction

|

At the time of Payment

|

Other points

|

no deduction on payment to heirs

|

Section 194H

|

|

Nature of Payment

|

Commission / Brokerage

|

Deductor

|

any person

|

Deductee

|

Resident

|

TDS rate

|

5 % wef 01.06.2016

|

Threshold Limit

|

15000 wef 01.06.2016

|

Time of deduction

|

credit or payment which ever is

earlier

|

Section 194G

|

|

Nature of Payment

|

Commission on Lottery

|

Deductor

|

any person

|

Deductee

|

Resident

|

TDS rate

|

5% wef 01.06.2016

|

Threshold Limit

|

15000 wef 01.06.2016

|

Time of deduction

|

credit or payment whichever is

earlier

|

Other points

|

|

Section 194I

|

|

Nature of Payment

|

Payment of Rent

|

Deductor

|

Any person other than

HUF/Individual

|

HUF-Individual :sales /gross

receipt exceeds one crore/50 lakhs

|

|

Deductee

|

Resident

|

TDS rate

|

Plant and Machinery/equipment :2%

Land /building/furniture -10%

|

Threshold Limit

|

180000

|

Time of deduction

|

credit or payment whichever is

earlier

|

Other points

|

TDS is deductible even if deductor

is not owner

|

Section 194IB(wef

01.06.2017)

|

|

Nature of Payment

|

Payment of Rent

|

Deductor

|

Individual or HUF(not covered under

audit 44AB)

|

HUF-Individual :sales /gross

receipt less than one crore/50 lakhs

|

|

Deductee

|

Resident

|

TDS rate

|

Rent 5 %

|

Threshold Limit

|

50000 per month

|

Time of deduction

|

Only Once in year -Last month of

agreement/Previous year

|

TDS rate without PAN

|

As per 206AA but maximum up to last

month Rent

|

Other points

|

TDS to be deposited under PAN no

TAN required

|

Section 194 IA(effective from

01.06.2013)

|

|

Nature of Payment

|

Payment of immovable property

|

Deductor

|

Any person other than

HUF/Individual

|

HUF-Individual :sales /gross

receipt exceeds one crore/50 lakhs

|

|

Deductor

|

any person

|

Deductee

|

Resident

|

TDS rate

|

1%

|

Threshold Limit

|

sale consideration up to 50 lakh

|

Time of deduction

|

At the time of Payment

|

Other points

|

Agriculture land not covered/TAN is

not required to be obtained

|

Section 194J

|

|

Nature of Payment

|

Fees for professional services

/Technical services/ royalty

/remuneration or fees or commission payable to director (not covered

under 192)

|

Deductor

|

Any person other than

HUF/Individual

|

HUF-Individual :sales /gross

receipt exceeds one crore/50 lakhs

|

|

Deductee

|

Resident

|

TDS rate

|

10% (2% on

Call centers wef 01.06.2017)

|

Threshold Limit

|

30000(no Limit for Payment to

director)

|

Time of deduction

|

credit or payment whichever is

earlier

|

Other points

|

No tds on profession services for

personal purpose

|

Payment of compensation on

acquisition of certain immovable property(194LA)

|

|

Nature of Payment

|

Payment of compulsory compensation

on acquisition of certain immovable property(other than agriculture land)

|

Deductor

|

Any person

|

Deductee

|

Resident

|

TDS rate

|

10%

|

Threshold Limit

|

sale consideration up to Rs 2.50

lakh

|

Time of deduction

|

At the time of

Payment(cash/cheque/draft or any other mode)

|

Other points

|

Any payemnt made under RFCTLARR Act

is exempted from TDS

|

A. Tax deduction at source and manner of payment in respect of certain exempt entities

The third proviso to clause (23C) of section 10 of the Act provides for exemption in respect of income of the entities referred to in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) of said clause in a case where such income is applied or accumulated during the previous year for certain purposes in accordance with the relevant provisions. Section 11 of the Act also contains provisions relating to income from property held for charitable or religious purposes.

At present, there are no restrictions on payments made in cash by charitable or religious trusts or institutions. There are also no checks on whether such trusts or institutions follow the provisions of deduction of tax at source under Chapter XVII-B of the Act. This has led to lack of an audit trail for verification of application of income.

In order to encourage a less cash economy and to reduce the generation and circulation of black money, it is inserted a new Explanation to the section 11 to provide that for the purposes of determining the application of income under the provisions of sub-section (1) of the said section, the provisions of sub-clause (ia) of clause (a) of section 40, and of sub-sections (3) and (3A) of section 40A, shall, mutatis mutandis, apply as they apply in computing the income chargeable under the head “Profits and gains of business or profession”.

It is also inserted a similar proviso in clause (23C) of section 10 so as to provide similar restriction as above on the entities exempt under sub-clauses (iv), (v), (vi) or (via) of said clause in respect of application of income.

These amendments is applicable in relation to the assessment year 2019-20 and subsequent years

B)Increase in cutoff of TDS deduction Limit u/s 194A for Senior citizen in respect of interest income from Banks & other institutions

At present, a deduction upto Rs 10,000/- is allowed under section 80TTA to an assessee in respect of interest income from savings account. In Finance Act 2018 a new section 80TTB has been inserted so as to allow a deduction upto Rs 50,000/- in respect of interest income from deposits held by senior citizens. However, no deduction under section 80TTA shall be allowed in these cases.

Further as the interest up to Rs 50000 is eleigble for deduction so amended in section 194A has been made in Finance act ,2018 so as to raise the threshold for deduction of tax at source on interest income for senior citizens from Rs 10,000/- to Rs 50,000/-.

For Other interest Limit remains Rs 5000 for senior citizen .

C) Tax deduction at source on 7.75% GOI Savings (Taxable) Bonds, 2018

Government of India introduced 8% Savings (Taxable) Bonds, 2003 in 2003. Under the existing law, the interest received by the investor is taxable. Further the payer is liable to deduct tax at source under section 193 of the Act at the time of payment or credit of such interest in excess of rupees ten thousand to a resident.

Government has now decided to discontinue the existing 8% Savings (Taxable) Bonds, 2003 with a new 7.75% GOI Savings (Taxable) Bonds, 2018. The interest received under the new bonds will continue to be taxed as in the case of the earlier once.

The provisions of section 193 has been amended in Finance act -2018 to allow for deduction of tax at source at the time of making payment of interest on such bonds to residents. However, no TDS will be deducted if the amount of interest is less than or equal to ten thousand rupees during the financial year.

D) TDS on Income from Long term capital gain u/s 112A on equity to Non Resident

10% Long term capital gain has been made applicable from 01.04.2018 for resident as well Non resident. However if payment is made to non-resident then TDS@10 % is also deductible.

Notes to TDS RATE CHART FY 2018-19 AY 2019-20:

- No TDS on

service Tax:

As per circular 01/2014 dated 13.01.2014 TDS is not applicable on

service tax part if service tax is shown separately.

- No TDS on GST: As per Circular 23/2017 ,TDS is not applicable on service tax part if service tax is shown separately.

- TDS at higher

rate i.e.,

20% has to be deducted if the deductee does not provide PAN to the

deductor.(read detail u/s 206AA)

- TDS on Good

Transport wef 01.06.2015: TDS shall be applicable on payment

to transporter wef 01.06.2015

.However tds exemption will be available only to those transporters who

own ten or less goods carriages at any time during the previous year. Such

a transporter would also need to furnish a declaration to that effect to

the payer along with the PAN.

- Surcharge on TDS

on salary is applicable if taxable salary

is more than 50 lakh @ 10%

and if salary is more than one crore @ 15 %

- Surcharge on tax other than salary is

not on payment made to resident.

- Surcharge on TDS applicable on payment made

to non-resident (See chart below) details )

- TDS is

deductible on full amount if threshold limit is crossed during the year

including the amount paid earlier during the year along with interest, if

applicable.

- No Cess on payment made to

resident: Health and education cess @ 4% is not applicable in case of resident

Individual /HUF/ Firm/ AOP/ BOI/ Domestic Company in respect of payment of

income other than salary. Health and

education cess @ 4% instead of education cess 3 % earlier is deductible at source in case

of non-residents and foreign company.

- Section 206AA in the Act makes furnishing

of PAN by the employee compulsory in case of receipt of any sum or income

or amount, on which tax is deductible. If employee (deductee) fails to

furnish his/her PAN to the deductor , the deductor has been made

responsible to make TDS at higher of the following rates:

- i)

at the rate specified in the relevant provision of this Act; or

- ii)

at the rate or rates in force; or

- iii)

at the rate of twenty per cent. The deductor has to determine the tax

amount in all the three conditions and apply the higher rate of TDS.

- However,

where the income of the employee computed for TDS u/s 192 is below taxable

limit, no tax will be deducted. Health and

education cess @ 4% is not to be deducted, in case the tax

is deducted at 20% u/s 206AA of the Act.

- In Case of TCS without pan

rate shall be 5 % or double of the prescribed rate ,whichever is higher.

- TDS by Individual and HUF (Non

Audit) case not deductible :An

Individual or a Hindu Undivided Family whose total sales, gross receipts

or turnover from business or profession carried on by him does not exceeds

the monetary limits (Rs.100,00,000 in case of business & Rs.50,00,000

in case of profession) under Clause (a) or (b) of Sec.44AB during the

immediately preceding financial year shall not be liable to deduct tax

u/s.194A,194C, 194H, 194I & 194J.So no tax is deductible by

HUF/Individual in first year of operations of business even sales/receipt

is more than 100/50 Lakh.

5.Surcharge /Cess applicable on TDS/TCS

1.Surcharge on payment made to resident

other than salary is

not deductible

2.In case of nonresident

shall be increased by a surcharge in the case of—

(i) every non-resident

being an individual or Hindu undivided family or association of persons or body

of individuals, whether incorporated or not, or every artificial juridical

person referred to in sub-clause (vii) of clause (31) of section 2 of the

Income-tax Act,—

(a) at the rate of ten per cent. of such tax,

where the income or the aggregate of income paid or likely to be paid and

subject to deduction exceeds fifty lakh rupees but does not exceed one crore

rupees;

(b) at the rate of fifteen per cent. of such

tax, where the income or the aggregate of income paid or likely to be paid and

subject to deduction exceeds one crore

rupees;

(ii) every

non-resident being a co-operative

society or firm or local authority

at the rate of twelve per cent.

Where the income or the aggregate of income paid or likely to be paid and

subject to deduction exceeds one crore rupees;

(iii) every

company other than a domestic company at the rate of two per cent. where the income or the aggregate of income paid

or likely to be paid and subject to deduction exceeds one crore rupees but does not exceed ten crore rupees;

(iv)every

company other than a domestic company at the rate of five per cent. where the income or the aggregate of income paid

or likely to be paid and subject to deduction exceeds ten crore rupees.

Surcharge /Cess applicable on TDS/TCS

|

||||

Particulars

|

Payment

|

Surcharge

|

Cess

|

|

Resident

|

Individual

|

Salary (up to 50 lakh)

|

No

|

Yes(4%)

|

Individual

|

Salary (50 lakh - 1

crore)

|

Yes (10%)

|

Yes(4%)

|

|

Individual

|

Salary (> I crore)

|

Yes (15%)

|

Yes (4%)

|

|

Non- corporate

|

Any

|

No

|

No

|

|

Corporate

|

Any

|

No

|

No

|

|

Non- Resident

|

Individual or HUF or AOP or BOI or every

artificial juridical person

|

Any payment up to 50 lakh

|

No

|

Yes (4%)

|

Any Payt (50

lakh-1crore)

|

Yes(10%)

|

Yes (4%)

|

||

Any Payments> 1

Crore

|

Yes(15%)

|

Yes (4%)

|

||

cooperative society-Firm

|

Any payment > 1

Crore

|

Yes (12%)

|

Yes (4%)

|

|

Non Domestic Company

|

Any payment (> 1 Crore

to 10 crore)

|

Yes (2%)

|

Yes (4%)

|

|

Any payment > 10

Crore

|

Yes (5%)

|

Yes (4%)

|

||

6. TCS (Tax Collection at Source Rates FY 2018-19 AY 2019-20

TCS

rate chart is given below for your ready reference.

TCS RATES FOR FY 2018-19 AY 2019-20

|

|

Nature of Payment

|

TCS Rate %

|

Scrap

|

1.00

|

Tendu Leaves

|

5.00

|

Timber obtained

under a forest lease or other

mode

|

2.50

|

Any other forest

produce not being a timber or tendu leave

|

2.50

|

Alcoholic Liquor

for human consumption

|

1.00

|

Parking Lot,

toll plaza, mining and

quarrying

|

2.00

|

Minerals, being

coal or lignite or iron ore (applicable

from July 1,2012)

|

1.00

|

Sale of motor

vehicle of the value exceeding Rs. 10 Lacs;(wef 01.06.2016)

|

1.00

|

Motor vehicle clause Not applicable

on Central Government, a State Government, an embassy, a High Commission,

legation, commission, consulate and the trade representation of a foreign

State; local authority ; a public sector company which is engaged in the

business of carrying passengers (wef 01.04.2017)

|

|

Bullion if

consideration (excluding any coin / article weighting 10 grams or less)

exceeds Rs. 2 Lakhs or

jewellery if consideration exceeds Rs. 5 Lakhs (and any amount is received in

cash)

|

Not applicable as cash transaction more than 2 Lakh not allowed

wef 01.04.2017

|

Sale in cash of

any goods (other than bullion and jewellery) or providing of any services

(other than payments on which TDS is made) exceeding Rs. 2 Lacs

|

|

TCS Rate without PAN

|

|

Double of TCS

rate as above or 5% ,which ever is higher

|

|

TCS RATES FY 2018-19

AY 2019-20 (Detailed)

Category-1

Every

person, being a seller, shall at the time of debiting the amount payable by the

buyer to the account of the buyer or at the time of receipt of such amount from

the said buyer, whichever is earlier, collect from the buyer of any goods of

the nature specified in column (1) of the Table below, a sum equal to the

percentage, specified in the corresponding entry in column (2) of the said

Table, of such amount as income-tax:

Nature

of Goods

|

RATE (in

%)

|

Alcoholic

liquor for human consumption

|

1

|

Tendu

leaves

|

5

|

Timber obtained

under a forest lease

|

2.5

|

Timber

obtained by any mode other than a forest lease

|

2.5

|

Any

other forest produce (not being timber/tendu leaves)

|

2.5

|

Scrap

|

1

|

Minerals,

being coal or lignite or iron ore

|

1

|

Category-2

Every

person, who grants a lease or a licence or enters into a contract or otherwise

transfers any right or interest either in whole or in part in any parking lot

or toll plaza or mine or quarry, to another person, other than a public sector

company (hereafter in this section referred to as "licensee or

lessee" ) for the use of such parking lot or toll plaza or mine or quarry

for the purpose of business shall, at the time of debiting the amount payable

by the licensee or lessee to the account of the licensee or lessee or at the

time of receipt of such amount from the licensee or lessee, whichever is

earlier, collect from the licensee or lessee of any such licence, contract or

lease of the nature specified in column (2) of the Table below, a sum equal to

the percentage, specified in the corresponding entry in column (3) of the said

Table, of such amount as income-tax:

Nature of contract or licence or lease, etc.

|

Rate (in %)

|

Parking lot

|

2

|

Toll plaza

|

2

|

Mining and Quarrying

|

2

|

Category-3

Every

person, being a seller, who receives any amount in cash as consideration for

sale of bullion or jewellery or any other goods (other than bullion or

jewellery) or providing any service, shall at the time of receipt of such

amount in cash, collect from the buyer, a sum equal to 1 % of sale

consideration as income-tax, if such consideration,—

(i)

for bullion, exceeds Rs. 2,00,000; or

(ii)

for jewellery, exceeds Rs. 5,00,000; or

(iii)

for any goods, other than those referred to above, or any service, exceeds Rs.

2,00,000.

The

above category has been abolished wef 01.04.2017 as cash receipt of Rs 2 lakh

or more attracts penalty of 100 % so no need to collect TCS on above category.

Category-4

Every

person, being a seller, who receives any amount as consideration for sale of a

motor vehicle of the value exceeding Rs. 10,00,000, shall, at the time of

receipt of such amount, collect from the buyer, a sum equal to 1% of the sale

consideration as income-tax.

In order to reduce compliance burden in certain cases, it is

proposed to amend section 206C, to exempt the following class of buyers such as

the Central Government, a State Government, an embassy, a High Commission,

legation, commission, consulate and the trade representation of a foreign

State; local authority as defined in explanation to clause (20) of Section 10;

a public sector company which is engaged in the business of carrying

passengers, from the applicability of the provision of subsection (1F) of

section 206C of the Act. This amendment will take effect from 1st April,

2017.

7. Due date to Deposit TDS and TCS & Mode FY 2018-19

To

Know the full concept of Due date to deposit TDS ,we must have to read it in

two Parts

- When Tax is to

be deducted/collected?

- When tax

deducted at source (TDS/TCS) is to be deposited (TDS due date of deposit)?

When

tax is to be deducted?

- At the time of

credit or payment, whichever is earlier

- 193-

Interest on securities

- 194A-

Interest Other than “Interest on securities”

- 194C-

Payment to contractors / sub contractors

- 194D

– Insurance commission

- 194H

– Commission or Brokerage

- 194G-

Commission on sale of lottery tickets

- 194I-

Rent

- 194J-

Professional or technical fees

- Before making

payment or distribution

- 194-

Dividend

- At the time of

payment

- 192-

Salaries

- 194B-

Winning from lotteries / crossword puzzles

- 194BB

Winnings from horse races

- 194EE

– Payment from National Saving Scheme

- 194F

Payment for repurchase of units by UTI / mutual funds

- 194

-IA : payment of transfer of immovable property >50 Lakh

- 194LA:

Payment of compensation on acquisition of certain immovable property

When

Tax is to be collected

- At the time of

Debit of Account or Receipt ,whichever is earlier

- Scrap

- Tendu

Leaves

- Timber

obtained under a forest lease or other mode

- Any

other forest produce not being a timber or tendu leave

- Alcoholic

Liquor for human consumption

- Parking

Lot, toll plaza, mining and quarrying Minerals, being coal or lignite or

iron ore (applicable from July 1,2012)

- At the time of

receipt/collection

- Sale

of motor vehicle > 10 lakh

When

date of deduction/Collection is decided then according to point of

deduction/collection then due date to deposit is to be decided as under.

Due

Date to Deposit TDS /TCS

|

||

Tax to be

deducted by Govt Office

|

||

1

|

Tax deposited

without challan

|

Same day

|

2

|

Tax deposited with

challan

|

7th of next month

|

Tax deducted by Non-govt

deductors

|

||

1

|

Tax deductible in

March

|

30th April of

next F.Y

|

2

|

other months &

tax on perquisites opted to be deposited by employer

|

7th of next month

|

TDS on transfer of Immovable property 194IA

|

||

1

|

Tax deductible in a

particular Month (up to 31.05.2016)

|

7th of next month

|

2

|

Tax deductible in a

particular Month ( wef 01.06.2016)

|

30th of next month

|

Tax Collected at Source (TCS)

|

||

1

|

Tax

collectable in a particular Month

|

7th of next month

|

Challan to deposit TDS and TCS & mode of

deposit

- For

all sections under TDS and TCS one challan is to be deposited

ie ITNS-281 and to

deposit TDS/TCS -TAN(tax deduction & collection account number is to

be obtained and used.

- Deductor can adjust excess tds

deposited in one section /assessment year with another section /assessment

year so no need to deposit section wise challan.

- However

for TDS collected under section 194IA (TDS on immovable property over 50

Lakh) tax is to be deposited on challan cum return 26QB.Further

to deposit this challan TAN number is not required though deductor will

FILL his PAN

- TAX

must be deposited through online mode only or through designated

bank branches.

Refund of Excess TDS deposited:

As pointed out above in point number 2, you may adjust excess TDS

in other section /assessment year/quarter. However if you want refund then you

may apply on form 26B online for excess TDS.

“Time and mode of payment to Government

account of tax deducted at source or tax paid under sub section (1A) of

section 192. Rule: 30.

(1)

All sums deducted in accordance with the provisions of Chapter XVII‐B

by an office of the Government shall be paid to the credit of the Central

Government ‐

- (a) on the same

day where the tax is paid without production of an income‐tax challan; and

- (b) on or before

seven days from the end of the month in which the deduction is made or

income‐tax is due under sub‐section (1A) of section 192, where

tax is paid accompanied by an income‐tax challan.

Tax

to be deducted/collected by Govt Office

|

||

1

|

Tax deposited

without challan

|

Same day

|

2

|

Tax deposited with

challan

|

7th of next month

|

3

|

Tax on perquisites

opt to be deposited by the employer

|

7th of next month

|

(2)

All sums deducted in accordance with the provisions of Chapter XVII‐B

by deductors other than an office of the Government shall be paid to the credit

of the Central Government ‐

- (a) on or before

30th day of April where the income or amount is credited or paid in the

month of March; and

- (b) in any other

case, on or before seven days from the end of the month in which‐ the deduction is made; or income‐tax is due under sub‐section (1A) of section 192.

Tax

deducted/collected by other

|

||

1

|

tax deductible in

March

|

30th April of next

year

|

2

|

other months &

tax on perquisites opted to be deposited by employer

|

7th of next month

|

(2A) Notwithstanding

anything contained in sub‐rule (2) ,any sum deducted under

section 194-IA shall be paid to the credit of the Central Government within a

period of seven days 30 days (wef

01.06.2016) from the end of the month in which the deduction is

made and shall be accompanied by a challan-cum-statement in Form No. 26QB

(3) Notwithstanding anything contained in sub‐rule

(2), in special cases, the Assessing Officer may, with the prior approval of

the Joint Commissioner, permit quarterly payment of the tax deducted under

section 192 or section 194A or section 194D or section 194H for the quarters of

the financial year specified to in column (2) of the Table below by the date

referred to in column (3) of the said Table:‐

SrNo

|

Quarter

ended On

|

Date of

payment

|

1

|

30th

June

|

7th July

|

2

|

30the

September

|

7th

October

|

3

|

31st

December

|

7th

January

|

4

|

31st

March

|

30th

April

|

8.Person required to file E TDS Return &

Duties of Deductor

For quick and efficient collection of taxes, the

Income-tax Act has incorporated a system of deduction of tax at the point of

generation of income. This system is called “Tax Deducted at Source” commonly

known as TDS. Under this system, tax is deducted at the point of origination of

income. Tax is deducted by the payer and the same is directly remitted to the

Government by the payer on behalf of the payee.

The provisions of tax deducted at source presently

apply to several payments like salary, interest, commission, brokerage,

professional fees, royalty, etc.

Meaning of TAN

Tax Deduction Account Number is a 10-digit

alphanumeric number issued by the Income-tax Department (herein after referred

to as ‘TAN’). TAN is required to be obtained by all persons who are responsible

to deduct tax at source (‘TDS’) except in case of a person who is responsible

to deduct tax at source under Section

194-IA.

Given below is an illustrative TAN:

DELM12345L

First 3 alphabets of TAN represent the jurisdiction

code, 4th alphabet is the initial of the name of the TAN holder. The next 5

digits of the TAN are system generated numbers between 00001 to 99999 and last

character, i.e., the tenth character is an alphabetic check digit.

Persons liable to apply for TAN

Every person who is liable to deduct tax at source

is required to obtain TAN. However, a person who is required to deduct tax

under Section 194-IA and 194IB can use PAN in place of TAN as he is not required to obtain

TAN.

Relevance of TAN

It is mandatory to quote TAN in following

documents:

(a) TDS statements i.e. return

(b) Challans for payment of TDS

(c) TDS certificates

(d) Other documents as may be prescribed

Penalty

If a person fails to apply for TAN or failed to quote

or quotes incorrect TAN in the above specified documents, a penalty of Rs.

10,000 shall be levied.

Procedure to obtain TAN

An application for allotment of TAN shall be made

in duplicate in Form No. 49B at any TIN Facilitation Centers (TIN-FC). Addresses

of TIN-FCs are available at NSDL-TIN website. Alternatively, one can apply for

TAN online at the NSDL-TIN website.

Charges for obtaining a TAN

A fee of Rs. 55 + service tax (as applicable)

should be paid as processing fee while submitting application for TAN.

Person liable to furnish TDS statement

Every person responsible for deduction of tax shall

furnish quarterly statements in respect thereof.

DUTIES OF TAX DEDUCTOR/COLLECTOR

- To

apply for Tax Deduction Account Number (TAN) in form 49B, in duplicate at

the designated TIN facilitation centers of NSDL(please see

www.incometaxindia.gov.in), within one month from the end of the month in

which tax was deducted. However for tax deduction

u/s 194IA (tds on transfer of immovable property) the

deductor may use PAN instead of TAN

- If

a deductor has many offices then deductor may take one TAN for all

branches or take separate TAN for each TAN. If separate TAN is taken

then deductor can

check TDS compliance report of all TAN at TDSCPC website

- To

quote TAN (10 digit reformatted TAN) in all TDS/TCS challans,

certificates, statements and other correspondence.

- To

deduct/collect tax at the prescribed rates at the time of every credit or

payment, whichever is earlier, in respect of all liable transactions.

- To

remit the tax deducted/collected within the prescribed due dates by using

challan no. ITNS 281 by quoting the TAN and relevant section of the

Income-tax Act.

- To

issue TDS/TCS certificate, complete in all respects, within the prescribed

time in Form No.16(TDS on salaries), 16A(other TDS) 27D( TCS).

- To

file TDS/TCS quarterly statements within the due date and revise the same

,wherever necessary.

- To

mention PAN of all deductees in the TDS/TCS quarterly statements.

TRACES online portal for

deductors and deductees :

TRACES is a web-based application of the Income Tax Department

that provides an interface to all stakeholders associated with TDS

administration. It enables viewing of challan status, downloading of Consolidated

File, Justification Report and Form 16 / 16A as well as viewing of annual tax

credit statements (Form 26AS). The deductor has to register at TRACES website

to avail facility available at the website

Facility available at Traces for deductors

- Download Consolidated File /

- Download Form 16 / 16A / 16B /

27D.

- Online

correction of TDS returns

- Refund of Excess

TDS

5. Justification

report: After

filing of the return, Department shall process the return and issue intimation

of return

processed without default or with defaults. The defaults are mainly on account of

deduction of tax at less rate , late filing of return ,interest due to late

deposit of Tax ,mismatching overbooking of challan , incorrect pan details etc.

In intimation only summary of default is sent to check the details deductor is

supposed to download

Justification report from TDSCPC website.

9. Due date TDS-TCS return 24Q, 26Q

,27Q,27EQ and Form 16 , Form 16A for Financial year 2018-19 for Govt as well as

non Govt deductor (notification 30/2012 dt 29/04/2016)

Quarterly return Form

Deductor

is required to file TDS/TCS return quarterly, however nil return is not

mandatory. These returns may be filed at any TIN-FC by paying a small fee.

However you may upload original

return directly at e filing site free.

- 24Q

: For

TDS deducted from Salary Income

- 26Q

: For

TDS deducted from all other section except salary & 194IA from

resident

- 27Q

: For

TDS deducted from Non-resident except salary

- 27EQ

: For

Tax collected at source

- 26QB : For section

194IA separate return is not required ,challan cum return is to be filled

on form 26QB (Tax to be deposited within 30 days(wef

01.06.2016)(earlier it was 7 days) from the end of the month in which tax

is to be deducted )

Due date TDS Return 24Q, 26Q ,27Q TCS

Return 27EQ Form 16 Form 16A for Financial year 2018-19 for

Govt as well as non Govt deductor

|

||||||

Sl. No.

|

QTR ENDING

|

RETURN

|

TDS-TCS Certificate

|

|||

TDS

|

TCS

|

FORM 16A

|

FORM 16

|

FORM 27D

|

||

1

|

30th June

|

31st July

|

15th July

|

15th Aug

|

15.07.2019 |

30th July

|

2

|

30th Sep

|

31st Oct

|

15th Oct

|

15th Nov

|

30th Oct

|

|

3

|

31st Dec

|

31st Jan

|

15th Jan

|

15th Feb

|

30th Jan

|

|

4

|

31st Mar

|

31st May

(30.06.19 Form..24Q) |

15th May

|

15th June

|

30th May

|

|

Nil TDS return is not mandatory

As per income tax rules/act Nil tds return is not mandatory,

however to facilitate the deductors and to update data Govt has provided a

facility on Traces website for

declaring NIL tds return.

Correction statement of E TDS

return

You may file correction return any number of times, No time limit

has been defined yet. This return can be filed with TIN-FC .To file the

revised TDS return you have to download consolidated FVU file from TDSCPS

website The correction return filing facility has not been provided at Income

tax India e filing site but we expect that soon it will be made available.

However you may correct challan

details/tag replace challan/allocation of interest and fees online/move deductee rows

from unmatched challan without digital signature at

www.tdscpc.gov.in and pan details with digital signature. If short payment of

TDS is not settled by Deductor then he cannot download form 16A/16 of that

quarter/year.

TDS Certificate

- Form

16 :

For tds deducted from salary

- Form

16A : For

other Tax deductions except salary & 194IA

- Form 16B : TDS from

section 194IA (to be issued within

45 days wef 01.06.2016)(earlier it was 22 days) from the end of the

month in which tax is to be deducted )

- All

above form must be downloaded from TDSCPC

(TRACES) website .However in case of Form 16 only PART-A is to

be downloaded from TRACES website. Earlier this was mandatory

for only companies ,Banks and co-operative societies engaged

in Banking services with effect from 01.04.2011 through circular

number 3/2011.

- Form

16A downloaded from TDSCPC can be signed manually or

can be authenticated through digital signature only.

Read more from links given below

- Procedure How to register

at TRACES (www.tdscpc.gov.in) and

- How to download Form 16A

form TRACES (www.tdscpc.gov.in)

- HOW TO DOWNLOAD

FORM 16 FROM TDSCPC WEBSITE

- How to download

Form 16B from TDSCPC website

10. Interest on Late deposit of TDS/TCS &

Penalty & Prosecution & other consequences on Non deposit of

TDS/TCS

As per income-tax act/rules, interest on late deposit of TDS is

payable under the following two circumstances

- Tax

is not deducted , when it was deductible

- Tax

once deducted, is not paid on or before due date

INTEREST ON LATE DEDUCTION/DEPOSIT OF

TDS-TCS

|

|||

Section

|

Nature

of default

|

Interest

|

Period

|

Interest

under section 201(1A)

|

Non-deduction

of tax at source, either in whole or part

|

1.00%

per month

|

From

the date on which tax was deductible to the date on which tax is actually

deducted

|

After

deduction, nonpayment of tax, either in whole or part. Non- payment of tax

u/s 192(1A)

|

1.50%

Per Month

|

From

the date on which tax was deducted to the date on which tax is actually paid

|

|

Simple Interest shall be calculated

and part of month will be treated full Month

|

|||

Consequences

if default is made in payment of TDS

A deductor would face the following consequences if he fails to deduct

TDS or after deducting the same fails to deposit it to the credit of Central

Government’s account:

·

a) Disallowance of expenditure: As per section 40(a)(i) of the Income-tax Act, any sum (other

than salary) payable outside India or to a non-resident, which is chargeable to

tax in India in the hands of the recipient, shall not be allowed to be deducted

if it is paid without deduction of tax at source or if tax is deducted but is

not deposited with the Central Government till the due date of filing of

return.

However, if tax is deducted or deposited in the subsequent year, as the

case may be, the expenditure shall be allowed as deduction in that year.

Similarly, as per section

40(a)(ia), any sum payable to a resident, which is subject to deduction of tax

at source, would attract 30% disallowance if it is paid without deduction of

tax at source or if tax is deducted but is not deposited with the Central

Government till the due date of filing of return.

However, where in respect of any such sum, tax is deducted or deposited

in subsequent year, as the case may be, the expenditure so disallowed shall be

allowed as deduction in that year.

The same rule is also applicable on Income from other sources.

·

b) Levy of interest: As per section 201 of the Income-tax Act, if a deductor

fails to deduct tax at source or after the deducting the same fails to deposit

it to the account of Central Government then he shall be deemed to be an

assessee-in-default and liable to pay simple interest as follows:

(i) at one per cent for every month or part of a month on the amount of

such tax from the date on which such tax was deductible to the date on which

such tax is deducted; and

(ii) at one and one-half per cent for every month or part of a month on

the amount of such tax from the date on which such tax was deducted to the date

on which such tax is actually paid.

·

c) Levy of Penalty: Penalty of an amount equal

to tax not deducted could be imposed under section

271C. Penalty shall be charged under section

221 if deductor fails to deduct

and pay tax to the credit of Central Government. The penalty shall be levied to the extent the Assessing Officer

directs, however, the total amount of penalty shall not exceed the amount of

tax in arrears.

d) Prosecution: If a person fails to pay to

the credit of the Central Government the tax deducted at source by him he shall

be punishable with rigorous imprisonment for a term which shall not be less

than three months but which may extend to seven years and with fine.

e) Dis allowance of Expenses : If TDS is not deposited with in due date of filing of Income tax return then 30 % of expenses on which TDS is deductible will be disallowed as expenses in current year under section 40A(ia)

11 : Late Fees -Penalty on Late filing of

TDS return

1. Failure to apply for TAN in time or Failure to quote allotted

TAN or Wrong quoting of TAN :

Penalty of Rs.10,000 is leviable u/s.272BB

2. Late Filing of TDS-TCS statement: Deductor will be liable to pay by way of fee

of Rs 200 per day till the failure to file TDS statement continues. However,

the total fee cannot exceed the amount of TDS deductible from which statement

was required to be filed.(section 234E) .Further as per section 234E ,Late fees

is required to be paid before the filing of TDS/TCS return. Read How to avoid

Late fees u/s 234E (read more post related to section 234E)

3. Failure to File TDS return on Time and filling of incorrect

statement: New Section for Penalty for non

submission of ETDS /ETDS return (section 271H)(applicable from 01.07.2012)

Failure to deliver statement within time

prescribed u/s 200 (3) or to the proviso to sub-section (3) of section 206C may

liable to penalty which shall not be less than Rs. 10,000/- but which may

extend to Rs. 1,00,000/-. No penalty if payment of tax deducted or collected

along with fee or interest and delivering the statement aforesaid before the

expiry of 1 year from the time prescribed for delivering the such statement.

However No penalty shall be imposed u/s 271H if the person proves that there

was reasonable cause for the failure.(section 273B)

4. Penalty on Late issue of TDS certificate form 16/Form 16A/form

27D/Form 16B :

If TDS certificate is not issued within

due date as prescribed then penalty @ 200 per day may be imposed till the

default continues for each default. However, the maximum penalty cannot exceed

the amount of TDS deducted for which TDS certificate was required to be issued.

5. Assessee In default (amendment in section 201)

The Deductor will not to be treated as

assessee in Default provided the resident payee has furnished his return u/s

139 and has taken into account such amount for computing income in such Return

of Income and has paid the Tax Due on the income declared by him in such return

of income and furnishes a certificate to this effect, duly certified by a CA,

in the prescribed form. This form is yet to be notified.

However, the interest for non deduction

of tax would be payable from the date on which such tax was collectible till

the date of furnishing of return of income by the resident payee.

12 .Various Passwords required to Use Traces

Website

Functionality

|

Password

|

Example

|

Password Formats for Tax Deductors

|

||

Registration

|

It should contain a minimum of

8 alphanumeric characters with

at least one capital letter.

|

Password123

|

Consolidated File

|

TAN_Request

Number of request submitted

|

DELA11111D_23456

|

Form 16/ 16A

|

TAN

in capital letters

|

DELA11111D

|

Justification Report

|

JR_TAN_FormType_Quarter_FY

|

JR_DELA11111D_24Q_Q3_2010-11

|

Intimation

through email |

TAN_Date

of filing original

statement

(in DDMMYYYY

format)

|

DELA_13102013

|

Password Formats for Tax Payers

|

||

Registration

|

It

should contain a minimum of 8 alpha numeric characters with at least one

letter in upper case

|

Password123

|

Form 26 AS

|

Date

of Birth (in DDMMYYYY format)

|

If your date of birth is 01-Feb-1980, password will be

01021980

|

Form 16B

|

Date

of Birth (in DDMMYYYY format)

|

If your date of birth is 01-Feb-1980, password will be

01021980

|

TDS RATE CHART FY 18-19 AY 19-20 VERSION: 1 UPDATED: 01/04/2018

Tags:tds rate chart,tds rates financial year 2018-19 ,tds rates ay 2019-20,tds calculator,tds deduction rate,revised tds rates,tds challan,tds rate contractors,Tds rates,tds rates 2018-19,new tds rates,tds rate chart,tds rate chart 2019-20,tds rate,new tds rate chart,tds on rent,tds chart 19-20,new tds rates 18-19 tds rate,tds rate ay 2019-20,tds rate after budget 2018,tds rate after budget,tds rate ,amendment,tds rate chart,tds rate chart 2018-19,tds rate chart 2019-20 in excel format,tds rate chart 2018-19,tds rate chart 18-19,tds rate chart for salary,tds rate chart from 01.04.2018,tds rate chart ,tds rate chart in excel,tds rate chart 18-19 pdf,tds rate brokerage,tds rate budget 2018,tds rate bank interest,tds rate for ay 19-20,tds rate from 01.06.2018,tds rate for 18-19,tds rate for advertisement,tds rate for non resident,tds rate for rent,tds rate for contractors,tds rate for professional fees,tds rate for transporter,tds rate for foreign remittance,tds rate 2018-19 ,tds rate assessment year 2019-20 tds rate agreement,tds rate and section,in tds rate and education cess in finance bill 2018 provisions,tds rate details,tds rate detail,tds rate india,tds rate in india,tds rate interest,tds rate in budget 2018,tds rate in delhi,tds rate in excel,tds rate in excel format,tds rate in india 2019,current tds rate in india,how to change tds rate in tally,tds rate chart,tds rate chart 2018-19,tds rate chart india,tds rate chart income tax,tds rate chart 2018-19,india tds rate current year,tds rate chart for 2018-19.Tds changes wef 01.04.2018 TCS TDS RATE WEF 01.04.2018

Complete details Of TDS rate changes for financial year 2018-19 Tcs rate changes, Due date to deposit TDS , Due date to issue Form 16, Due date to issue Form 16A , Due date for filing E-TDS return Form 24Q/26Q,27EQ , Penalty and interest provision for late deposit of TDS ,consequences for default in filing of E tds Return , TDS rate applicable in case of Non submission of PAN ,TDS rate applicable on service tax or not , on job work or not , which rate is applicable to individual , HUF, who should deduct TDS , who should not deduct tds ,whether tds should be deducted on service tax on rent or professional services all such topics has been covered here under.Passwords to open various TRACES/e filing related files/utilities

TDS RATE CHART FY 18-19 AY 19-20 VERSION: 1 UPDATED: 01/04/2018

TDS Not applicable on GST also.You have mentioned about Service Tax only.Please update it along with circular reference.

ReplyDeleteThanks Sudheer , Relevant point added in Notes

DeleteIt is mentioned that for Dividends the cut off is 2500/-. SO do we need to do TDS on Dividend paid beyond 2500? Please clarify and advise.

ReplyDeleteIn my view Deemed dividend is covered under this section. On normal dividend ,dividend distribution tax is applicable .

Deletepls share GST rate with xl sheet

ReplyDeleteOKK

Deletepls share the GST Rate with product wise

ReplyDeleteThis clear explanation, I have ever seen my past. Tq for your valuable information buddy.

ReplyDelete